Succession – A Vital Part of Family Firm Longevity

We are excited to present in this issue of The Family Business Bulletin information about a critical element in family business survival – succession planning and management. Here you’ll find global insights as well as practical advice derived from research and classroom lessons. This information will provide useful insights into 1) succession readiness of leaders and successors, 2) important attributes of successors, 3) the importance of successor willingness and ability, and 4) storytelling as a way to share family legacy.

INFORMATION – Proactive Readiness

Succession Readiness in the Family Firm

Smooth Role Transitions for Leaders and Successors

by Dr. Laura Marler

Family firms often operate with the assumption that the firm will remain owned and operated by members of the family. When a business is transferred from one generation to the next, intra-family succession has taken place.

What is intra-family succession?

The survival of a family firm is contingent on intra-family succession. A succession transition is characterized by a change in leadership roles and ownership in the family firm. This makes it sound as though it is a one-time event. Yet, succession is a complex process that often unfolds over a period of years and involves numerous changes, including significant role transitions for both the current leader and the prospective successor.

Leaders and Successors

The current leader, often referred to as the leader incumbent, will shift into another role, either one outside the firm or a smaller, supportive one within the firm that is often symbolic. Ultimately, that person’s leadership will diminish, and he or she will no longer make strategic decisions. A leader incumbent often experiences a sense of loss and may even be resistant to change. The successor is typically the less-experienced, younger individual taking on the leadership role in the firm. He or she will be responsible for making future strategic decisions and will take on managing the demands of the family firm.

Smoothness of Succession

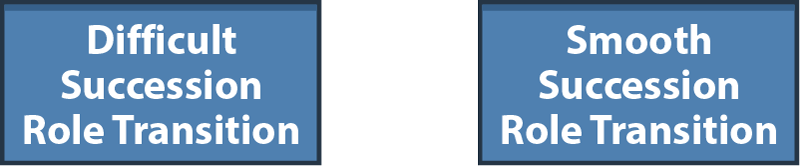

The succession process may go smoothly or may be fraught with conflict and bumps along the way, even jeopardizing firm survival. A smooth succession process is characterized by leaders and successors who are prepared for new roles and satisfied once they are in those roles. This is the result of the leader and the successor mutually agreeing on and engaging in new roles. Two key factors are paramount to a smooth transition: a proactive approach that prepares both parties and succession readiness.

The Importance of Proactivity

Proactive individuals are characterized by their anticipatory thinking as well as their ability and willingness to take on new roles. Proactively preparing for the process will give the leader and the successor time to navigate the challenges in the process. Far-sighted, prepared successors are central to the continued functioning of a family firm and are likely to take on new roles more easily than their passive counterparts. Similarly, proactive leaders often train successors by exposing them to the business even at a young age – sometimes requiring them to work in various parts of the company. They have future change in mind and are actively taking steps to prepare the successor who will one day take over. This type of training requires anticipatory thinking on the part of the leader incumbent. Some family firms require their successors to work outside the organization for a period of time, which aids in the acquisition of general business knowledge and provides broader exposure. A passive leader, on the other hand, will more likely wait for succession to unfold and feel less responsible for shaping the process.

Leader willingness to let go and successor willingness to take initiative

Proactivity alone is not enough to ensure the success of the transition process. Given the emotional elements of succession, a leader may not be ready, in which case the process is expected to be less smooth. The former leader’s willingness to “let go” of a leadership role is critical. Post-succession acceptance of a successor as the new leader of a business is more likely when the incumbent has worked to transition out of formal leadership and is willing to let go of the reins. Similarly, successors who are succession-ready demonstrate willingness to take initiative in new ways that prepare them to step into the role of family firm leader.

Whether a firm survives a leadership transition is contingent on many factors, but at the heart of the matter is whether the leader and the successor are ready and willing to move into new roles. Ideally, both parties take a proactive approach and are succession ready.

Adapted from: Marler, L. E., Botero, I. C., & De Massis, A. (2017). Succession-related role transitions in family firms: The impact of proactive personality. Journal of Managerial Issues, 29(1), 57–81.

DATA – The World

What Do Family Firms Look for in the Next CEO?

Lessons Across Continents

by Dr. Jim Chrisman

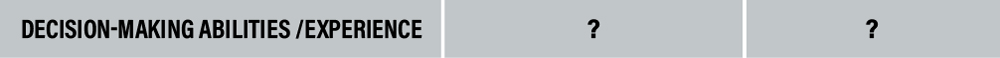

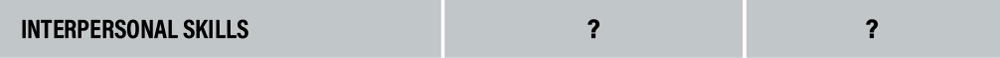

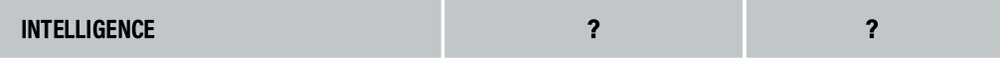

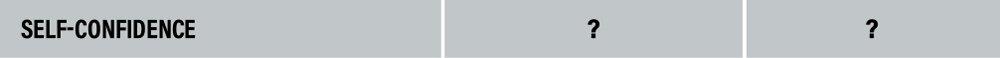

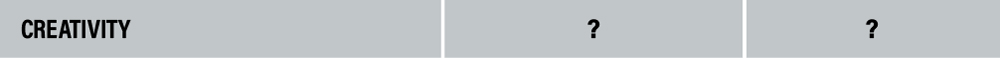

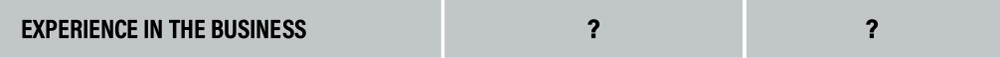

Can you guess how successor attributes were ranked by CEOs of family businesses?

One of the most important decisions a family firm must eventually make is whom to appoint to succeed the incumbent leader of the business. In this article, we summarize the results of two classic studies that sought to identify the most important attributes a successor must possess to be selected as the new CEO of a family firm.

The first study was conducted among 485 members of the top management teams or boards of directors of family firms in Canada, and the second was conducted among 43 executives holding similar positions in family firms in India. Combined, these studies paint an interesting picture of successor attributes that are universally valued and those that vary according to the institutional environment. We selected 30 attributes to measure in the areas of:

(1) relationship to the incumbent

(2) relationship to other family members

(3) family standing

(4) competence

(5) personality traits

(6) current involvement in the family firm

The most important and startling finding is that both groups of respondents rated integrity and commitment to the business as the most important attributes for successors to possess. This suggests that more than skill, education, experience, intelligence, creativity, and good relationships with family and nonfamily members, incumbents want successors who will do the right thing and can be counted on to do what is right for the business.

Although not as strongly rated as integrity and commitment, respondents from both studies scored respect of employees, decision-making skills, intelligence, self-confidence, and creativity among the top 10 attributes. Interestingly, Canadian executives also mentioned interpersonal skills, experience in the business, and past performance as top 10 attributes whereas Indian executives included trust of family members, ability to get along with them, and respect of the actively involved family members in their 10 most important attributes. These distinctions suggest that executives in Canada value attributes associated with the ability to run the business effectively and efficiently, whereas executives in Indian family firms are swayed more by successors’ potential to work effectively with others and maintain relationships that allow them to call on other family members when needed.

Examining the attributes that show the greatest divergence underscores the above conclusion. Thus, Canadian leaders also value marketing skills much higher than Indian leaders. In contrast, Indian leaders rank blood relations much higher than Canadian leaders. The only attribute that seems to defy the general distinction is that Indians rank willingness to take risks substantially higher than Canadians do.

Finally, we consider the fact that attributes such as gender, birth order, and age are ranked near the bottom of the scale by both groups, in very different institutional environments, to be a positive indication that merit rather than identity is considered more important in family firms.

Overall, the most significant finding is that integrity and commitment to the business are the two most desirable attributes a successor can possess. In this regard, we speculate that it may be the perceived greater ability of the incumbent leader to gauge the integrity and commitment of family members that explains why intra-family succession is so common even when the managerial ability of the family successor is in doubt. On the other hand, as a cautionary note, it might also be the case that the incumbent leader’s misperceptions about the readiness of the successor explain why only about 10 to 15 percent of family firms make it into the third generation.

Take an assessment of your family business leaders using the attributes below to see how your company compares to those in other parts of the world. Do integrity and commitment stand at the top of your list?

Adapted from: Chrisman, J.J., Chua, J.H., & Sharma, P. (1998). Important attributes of successors in family businesses: An exploratory study. Family Business Review, 11, 19-34, and, Sharma, P., & Rao, S. (2000). Successor attributes in Indian and Canadian family firms: A comparative study. Family Business Review, 13, 313-330.

INFORMATION – Keys to Success

Succession Done Right

Insights from the Classroom and The Little Dooey

by Chelsea Sherlock

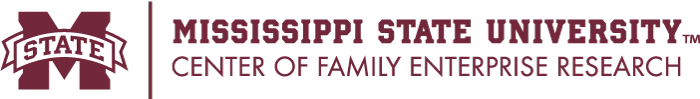

Succession is one of the most important and challenging events in any family business. Across family-controlled businesses, 70 percent do not survive to the second generation, and of those that do, over 90 percent do not make it to a third generation (Poza & Daugherty, 2015). In our Family Business Management course (MGT3713) we discuss how a smooth and successful leadership transition depends on two fundamental dimensions: the willingness and the ability of the next generation to take over. Willingness refers to whether the next generation successor wants to lead the business. Whereas, ability connotes whether the successor can do the job by developing the knowledge, skills, and abilities needed to do the job well. Both dimensions matter, and both must be nurtured over time.

Ability, meanwhile, doesn’t happen by accident. Throughout the semester, students are encouraged to think of ways for their own families to plan ahead and invest in the next generation’s development. Students often discuss being encouraged to work outside their family businesses before joining. This mindset allows next generation members to gain knowledge and skills from outside companies before going to work for mom and dad. However, joining the family business may sometimes be a byproduct of the economy and job market (Wall Street Journal), so it is critical that family businesses ensure the next generation is qualified in their new roles. When the next generation both wants to lead and is prepared to lead, the groundwork is laid for not just a smooth transition, but also a stronger future for the family and the firm.

Through the course project in Family Business Management, we saw that willingness and ability were both evident in the succession planning of The Little Dooey Restaurant, a beloved Starkville institution owned by the Wood family. Currently operated by Bart Wood, a second-generation family member, the restaurant is preparing for a third-generation transition, with Bart’s son, Carter, set to take the reins. Bart emphasizes that effective succession involves providing the next leader with opportunities to understand both the operations and the governance of the business. He attributes The Little Dooey’s longevity to its values, its people, and its passion. He emphasizes that his company has developed a clear succession plan to preserve the founding principles instilled by his parents, Margaret and Barry, when they started the business. It’s no wonder that their barbecue remains a perennial favorite!

TIPS – How to Tell Your Story

Timing Matters for Succession Planning

How Often to Share Your Family Business Story

by Jorge Arteaga-Fonseca

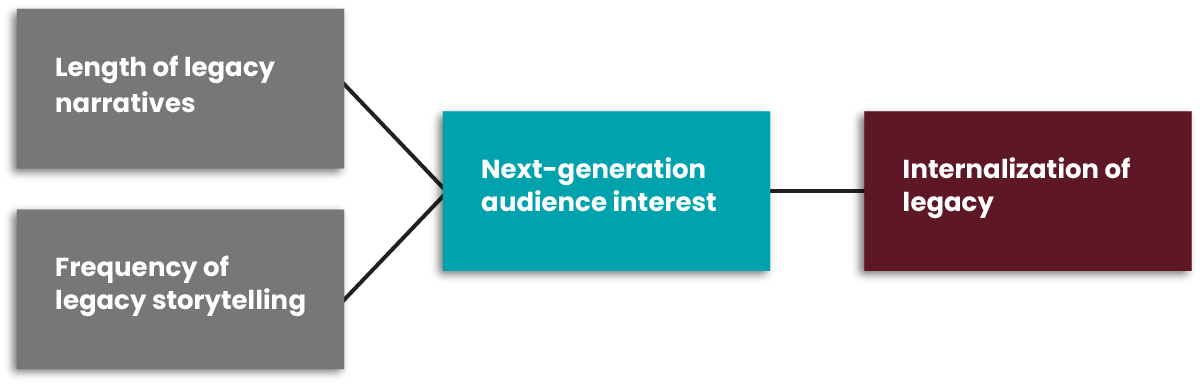

Storytelling is a way that family legacy is shared across generations within family businesses. A legacy encompasses the values, traditions, and memories passed down through generations that shape a family’s identity and sense of belonging. It is commonly shared with newer generations through stories that play crucial roles in whether future generations internalize their families’ identities – potentially enhancing successor commitment and readiness for succession.

Our study provides guidance for family businesses on how to best use storytelling.

- Should I share as much about our legacy as possible with younger members of the family firm?

- When sharing the family legacy story, more is not necessarily better.

- How often should we be telling our story?

- We found that if stories are shared once a week, future generations will lose interest and are less likely to internalize their families’ legacies.

- Sharing stories once a month or occasionally in meaningful ways will increase future generations’ interest and internalization. For example, family members can share legacy stories at meaningful events like the annual holiday party.

- How long should storytelling last if I am sharing my family’s story?

- Stories ideally have to be of moderate length to best capture the interest of next generation audiences.

- Key takeaways

- The audience is just as important as the storytelling.

- Storytelling aids in helping future generations internalize family firm values.

- The frequency with which stories are relayed must be managed carefully to strike a balance. The story should be told frequently enough to capture the interest of the future generation without being so cumbersome as to create boredom.

Zhang, Y., Arteaga-Fonseca, J., Rutherford, M. W., & Edwards, B. D. (2025). More is not always better: a psychological reactance perspective on legacy stories. Journal of Small Business Management, 1–35.

Mississippi SBDC

America’s SBDC

Mississippi State University is an equal opportunity institution.

Editor: Dr. Laura Marler

Head, Department of Management & Information Systems & Jim and Pat Coggin Endowed Professor of Management